tax strategies for high income earners 2021

If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. One of my favorite tax strategies for high income earners is investing in real estate.

Here S How Rising Inflation May Affect Your 2021 Tax Bill

This is one of the most basic tax strategies for high income earnersthat you can take advantage of.

. Pay taxes now at what may ultimately be lower marginal rates than you would be subject to in the future when you make withdrawals. The total contribution limit for a 401 k plan in 2021 is 58000 plus an additional 6500 for those 50 and older or 100 percent of an employees compensation whichever is lower. Family Income Splitting and Family Trusts.

The main reason is that youre able to recover the cost of income-producing property through the use of depreciation. Asset Protection For Business Owners And High Income Earners How To Protect What You Own From Lawsuits And Creditors Ebook By Alan Northcott Rakuten Kobo Higher Income Asset Business Owner. Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000.

This can help you build tax-free wealth for your future needs or for your heirs to inherit. Thats a tax saving between 9360 24 marginal rate and 14430 37 marginal rate. When you invest in an RRSP the amount of your contribution is deducted from your taxable income thereby reducing your tax bill.

These retirement accounts use pre-tax money so you can deduct. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. If youre a high-income earner wanting to reduce your taxable income start with these five strategies.

Of course the first step in saving for retirement is to maximize those plans contribute to the maximum allowable limit. These federal tax brackets enable one to understand the need and types of tax-saving strategies for high-income earners. We all know that wage income earners pay a higher percentage of their income in taxes compared to those people who have invested their wealth.

Potential changes coming up the legislative pipeline could also. The same donation amount will help the high-income earner save 185 in taxes while the taxpayer in the 10 tax bracket will save. There are only so many pre-tax avenues to retirement income.

401 k and 403 b helps in that every dollar you put in is not taxed until you take it out. Single and head of household filers covered by a workplace retirement plan. The salary limit for deferring compensation is 280000 for 2021.

The contribution you will make will come straight out of your. Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000. Tax Strategies for.

The IRS allow owners of resident occupied real estate to depreciate property over 275 years. Tax planning can be one of the most essential elements of tax-saving strategies for high-income earners. Tax Filing Status.

It works by setting up a prescribed rate loan. You can use the money to pay for medical and dental expenses including some over-the-counter medicines. You are allowed to put in 3600 per individual per year and 7200 for families in 2021 and 3650 and 7300 for families in 2022.

For high-income earners charity contributions often generate more tax savings compared to low-income earners. Despite the increases of the standard deduction limits in recent years it may still make sense for high earners to forgo the standard deduction and opt for itemized deductions. Here are a few smart tax strategies to incorporate in the course of 2021.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Max out your retirement plan contributions. Consider a 500 donation from a high earner in the 37 tax bracket and a similar donation amount from a taxpayer in the 10 bracket.

Max Out Your 401k The contribution limit for an individual in 2021 is 19500. The highest income earner pays 37 of his or her income in federal income tax while the highest tax rate for long-term capital gains is 20. This money is put in the account before taxes lowering your taxable income.

If you make more than this amount this doesnt mean you cant contribute to your 401. The importance of tax planning for high-income earners. Married filing jointly.

Take advantage of the lower rates under the Tax Cuts and Jobs Act before they sunset in 2025. For 2021 the standard deduction is 12550 for single filers and married filing separately 25100 for joint filers and 18800 for head of household. In 2021 the employee pre-tax contribution limit for 401k and 403b plans is 19500.

The top rate for 2021 applies to individuals earning more than 523600 or more than 628300 for married couples filing jointly. A married couple can reduce taxable income by 39000. Well discuss a few tax shelters for high income earners that can potentially help you save millions of dollars if implemented correctly by an expert.

The top bracket of. In 2021 the employee pre-tax contribution limit. Here are some of our favorite income tax reduction strategies for high earners.

High earners who want to put more dollars aside must find alternatives beyond such traditional means as 401ks and IRAs. The top rate for 2021 applies to individuals earning more than 523600 or more than 628300 for married couples filing jointly. Specifically contribute to a traditional 401k or IRA.

50 Best Ways to Reduce Taxes for High Income Earners. Tax rates vary depending on the trends in the economy.

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Budget 2022 Main Points What S In It For You

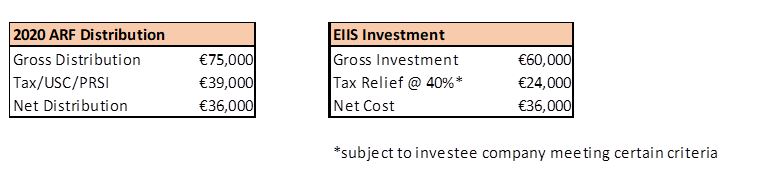

Eiis In Arf Pension Tax Efficient Investment Options

Tax Strategies For High Income Earners Pillar Wealth Management

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Changed Income Tax Regime Needed If We Are To Continue Attracting Talent

Pin By Niina Felushko On Financial Matters Senior Discounts Efile Tax Return

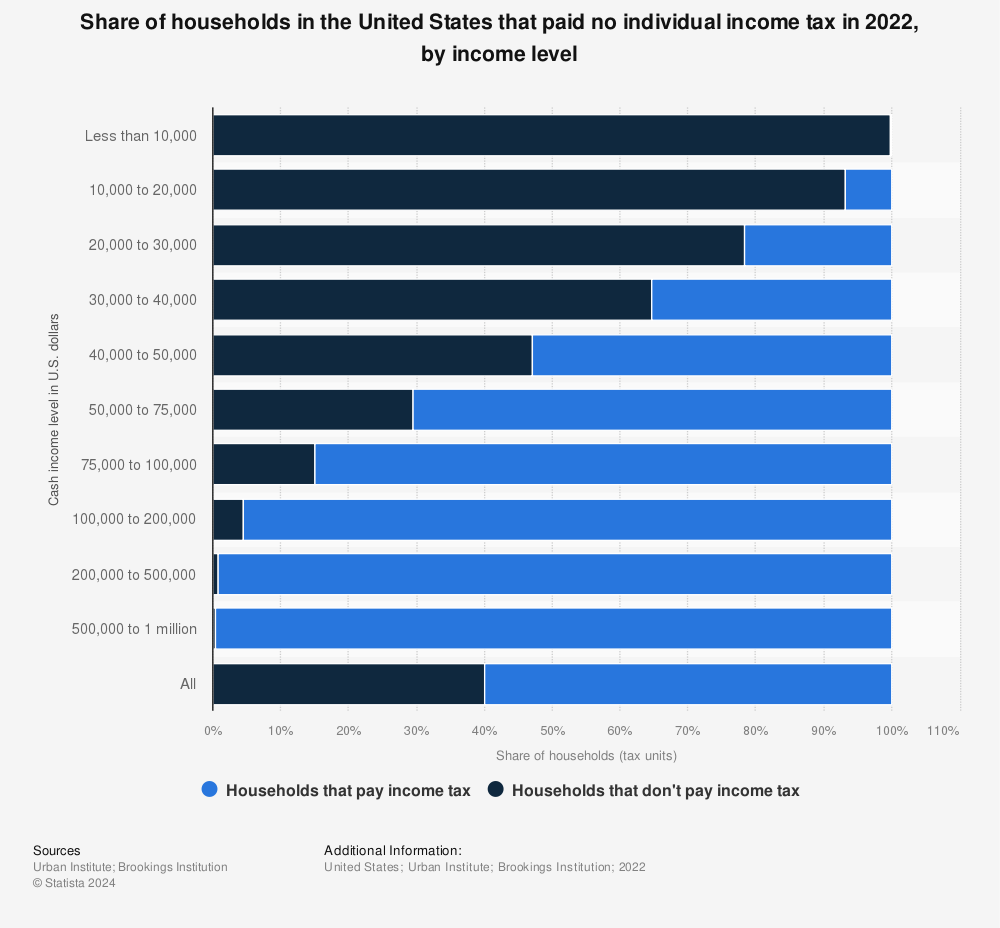

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

France Cryptocurrency Tax Guide 2021 Koinly

Eiis In Arf Pension Tax Efficient Investment Options

Why Do Some Investors Pay More Tax Than Others

Personal Tax Budget 2022 Taxing Times Kpmg Ireland

How To Reduce Your Income Tax Bill Now In One Fell Swoop Ocean Finance

How To Reduce Your Income Tax Bill Now In One Fell Swoop Ocean Finance

Irmaa 2021 High Income Retirees Avoid The Cliff Fiphysician Com Higher Income Income Paying Taxes

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)